"It's often said that purchasing a home is the biggest financial transaction of one's life. I would counter that marriage is the biggest financial transaction of one's life."

Over the years, I've often told my sons (although applies equally to daughters as well) that marriage is a financial contract. While few (especially young people) enter a marriage with that thought in mind, I think that they would be better served if they did. Oddly enough, marriage is one of those contracts with little upfront fine print, yet there's a lot of moving parts that can go wrong -- which is where a contract, and the discussions and negotiation that ensue prior to entering the contract -- could be very beneficial!

One of those elements is as simple as a disparity in income - one person's standard of living is generally going to go up, and the other person's will go down. What about your bride-to-be/groom-to-be/partner-to-be's credit score? That could be an issue if you're trying to purchase a home in Southern California's competitive housing marketing. How about credit card debt, car loans, student loan debt, and overall debt load as one enters into matrimony? Any investments or assets in the mix? (if there are assets available, both parties might want to avail themselves of this quick read, written by a friend of mine, Larry Hennessey - Look Forward; Plan, Save, and Reward Yourself - Investing is not Rocket Science! Free to my blog readers). Again, all not very romantic, but certainly important to have out on the table prior to hitching one's financial wagon to another person's, prior to tying the knot. After all, once you say "I do", you've handed over the keys to your financial world to another person, and vice-versa.

The reality is that such a contract exists -- a prenuptial contract or agreement -- but just the name has a negative connotation. We've all read about the prenuptial agreements of the rich and famous, who seem to need them on a frequent basis to protect their ample assets. But doesn't a prenuptial agreement throw a wet blanket on the whole discussion of marriage? After all, don't people marry for love? Maybe we just need to change the name to something simpler and without the baggage of the term "prenuptial agreement" -- maybe "marriage guidelines" or something not quite as sinister as the dreaded "prenuptial agreement"!

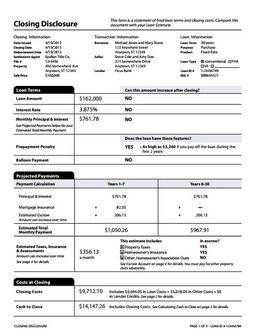

By comparison, a typical real estate contract in California is, in a fairly small font, 15 to 27 pages in length (plus or minus -- it depends on the disclosures included with the original Agreement) and that doesn't include the pages of disclosures, addendums, clarifications, escrow instructions, etc. Loan documents add another impressive stack of paperwork that must be read, digested, and agreed to, before title to a house can change hands. The good news is that should something not seem right during the due diligence process (analogous to the engagement period for folks getting married), then the agreement can be consulted to determine the available remedies. Occasionally, the remedy isn't sufficient for one party or the other, and the contract is dissolved -- much better to happen during the escrow/due-diligence/engagement period than after the deal is closed ("I do"). It's often said that purchasing a home is the biggest financial transaction of one's life. I would counter that marriage is the biggest financial transaction of one's life -- the paperwork required? A single page marriage license -- no fine print, no clarifications, no disclosures. What could possibly go wrong? Well, as the rate of divorce implies -- a lot!

In the interest of full disclosure, I've been happily married for 30 years of this writing and do not have a pre-marriage agreement.

RSS Feed

RSS Feed