Click to Enlarge

Click to Enlarge Well, until it isn't! I purchased a unit online about 5 years ago for a small rental property. The equipment was purchased online and installed by a licensed HVAC professional. Per the manufacturer's warranty, as long as the system is installed by a licensed HVAC professional the warranty is valid. The warranty is 5 years from date of install, and the compressor is warranted for another 2 years (or 10 years from date of install if installed by a factory-trained technician). Note that some factory warranties on these systems specifically exclude systems purchased online.

After about 5 years of very light use, the system quit functioning and displayed an error code. The manufacturer has multiple websites, and it took me awhile to find the website that had authorized factory technicians available in my area. To get to this point, I had multiple chat sessions with reps from the factory, who eventually would tell me that they couldn't assist me, as their group only handled window/wall AC units (this was after telling them that it was a mini-split, along with the model #'s and serial #'s of the units) -- so a very frustrating experience. Likewise, after re-registering my system, the webpage asked if I needed service. Clicking on the "Yes" button provided a multitude of products that they manufacture, with the exception of mini splits, which seem to not be on their radar whatsoever, in spite of them being a major brand/manufacturer of this type of product. Again, more frustration.

So, the "factory-trained" technician came out that afternoon. Nice guy, but clearly, he had never worked on this model of system, continually calling it an "older system" (it was 5 years old). He pulled on the cover of the interior unit so hard that I was sure that he would break some of the brittle plastic components (and as it turned out -- he did break a few pieces, and just stuffed them back inside of the non-working unit, hoping that I wouldn't notice. He did offer to sell me a new system, of course!).

Eventually, I was able to procure an appointment with another "factory-trained" technician, but he was about 3 weeks out. I procured a small space heater for my Tenant in the interim, but this was the only factory-trained technician available at all, so we waited. When the day arrived, they did some troubleshooting on the system, which resulted in the diagnosis of a malfunctioning printed circuit board (basically the CPU for the system). I was expecting it to be fairly expensive ($300-$500) but less expensive than a new system -- and of course they would have to replace the damaged plastic components/gears damaged by the previous technician. The service call was $285, but at least I had an answer -- well, kind of. Apparently, they don't manufacture that printed circuit board any longer, and it's not available. So much for a 10-year warranty if one can't get parts!

In the interim, I continued a dialogue with the manufacturer, who eventually indicated that my case had been sent to the "Presidential Liaison Group" (sounds impressive!) and that I should hear from them within 5-7 days. 2 weeks later I let them know that I still hadn't heard from the President's people, but after that prodding I heard from them shortly thereafter. Of course, I had to resubmit all of the info that I had submitted prior (receipts, model #'s, serial #'s, etc.). But all good, as I was now in the capable hands of the President's own personal customer service team! This turned out to be the equivalent of the world's slowest chat session. They would ask for something, or ask a question, and I would respond immediately. Several days later, that would ask for something else, and I would respond. Rinse and repeat for a couple of weeks. Eventually they told me that I would be getting a store credit for essentially the amount that I had originally spent on their system -- fair enough, except their online store doesn't sell mini-splits (of course!). But I could use a through-the-wall AC unit for another rental, so all was not lost.

The next thing that I had to provide to receive the credit was the model # and serial # stickers from the units, cut in half (or at least photos of them cut in half). They were in difficult to reach places, and it required a hairdryer or heat gun to soften them enough to remove without damaging. So, I had to wait until the units were de-installed to provide the stickers. Once that information was provided, I was promptly informed that "I noticed that there's an issue to raise or clarify with another department before we process your Reward request. We will let you know once we get a response from them. Thank you." And so, the waiting begins!

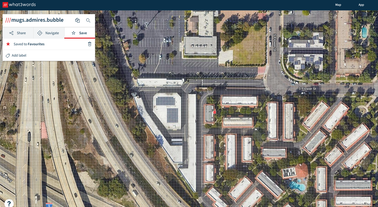

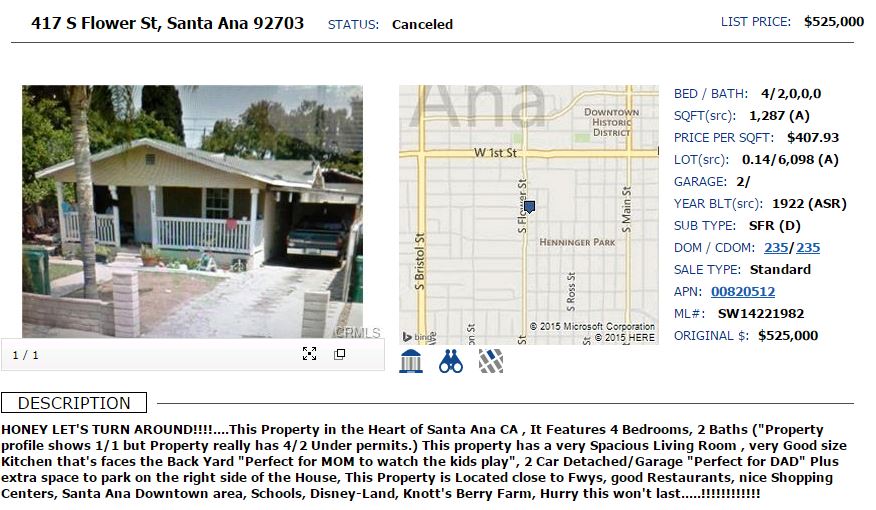

I contacted the de-facto leading manufacturer of mini-splits and was directed to a local gold-plated distributor/technician. If a system was provided/installed by their gold-plated personnel, I would receive a 12-year warranty on the system (nice) but the cost to provide/install was $5,700. To purchase just the system online, is $1,370 including shipping/sales tax (although I'm told that, for some reason, the distribution warehouses from which the HVAC techs have to purchase these systems, charge the HVAC techs more for the systems than the online prices -- so no deals for them). So, I could purchase 3 of these systems online, and still pay someone $1,590 to install the first one and would arrive at the same price (and have 2 spares, regardless of the length of the warranty). Note that the installation time to swap out an old system for a new system is about 3.5 hours -- at least that's what it took the HVAC tech to swap out the old system and replace it with another of the top 3 brands -- so $1,590 is probably a little on the high side for installation as well. I understand that one is paying for overhead, tools, trucks, insurance, experience, etc. but in this instance, I felt that the premium was just too high.

So, the moral of the story is that mini-splits are still a quiet and efficient solution for may applications, but that getting them repaired may be problematic as repair knowledge and parts availability could be an issue. One HVAC tech told me that it's not uncommon to be on the phone with tech-support for 2-3 hours (waiting for a call to be answered) and customers don't want to pay for that wait time, which is understandable. Like window and/or wall air conditioners, they may simply be throwaway systems once they begin malfunctioning. Hopefully once these units become more easily repairable, and/or the supply chain for parts becomes more reliable, these systems will be a fantastic alternative to traditional HVAC systems. But for the moment, leaving a Tenant boiling in the heat or freezing during the winter for several weeks while waiting on a technician and/or parts isn't realistic -- it may be best to just replace with a new system.

Oh - and I still haven't heard back from the President's folks on the status of my "Reward"!

RSS Feed

RSS Feed