Click to Enlarge

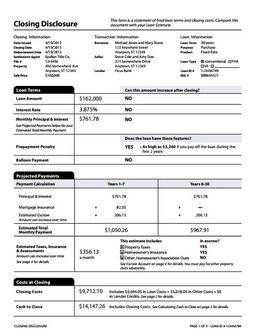

Click to Enlarge On the surface, the revised forms and timeframes are designed to assist consumers in making informed choices -- that's a good thing. I can speak from experience -- when I purchased my first home in the mid 1980s (from the builder) no one mentioned anything about "closing costs". When escrow called me to have me bring in my funds a few days prior to closing, the number that that quoted me was wildly above my expectations -- I had to scramble to come up with a few extra thousand dollars that I wasn't anticipating -- all very stressful! And it's not uncommon to meet with first time buyers today who, after learning of the incremental impact of closing costs, elect to put things off for a few more months while they save up the necessary funds.

The new forms should be more straightforward for buyers to understand (I use a spreadsheet that I've developed to essentially accomplish the same objective - to lay out ALL of the expected upfront and monthly costs involved with purchasing a home) and is to be delivered by the lender to the buyers no later than 3 business days after the loan application is completed/signed. No problem there.

Where the industry might run into issues is with the final set of paperwork required to be delivered to the buyer, which compares the initial estimates with the actual costs -- again, a good thing for consumers (and in an easy to understand format). Where the law of unintended consequences might strike, is that it must be delivered to the buyer at least 3 business days prior to loan docs being signed. While it sounds good in theory, it may cause some issues. A last minute credit from Seller to Buyer that changes the APR by more than 1/8th of a point? New TILA documents and a new 3-day waiting period. "But wait a minute, I've got the movers scheduled for this weekend!" Sorry, you will need to reschedule (if you can). "Escrow forgot to credit me the $$ that we negotiated for repairs!" Oops -- new TILA documents may have to be sent out -- another 3 day waiting period goes into effect. Factor in 2 or 3 houses that need to close concurrently so that buyers and sellers can "move-up" and the situation gets even worse!

It will be interesting!

Click here for additional information.

RSS Feed

RSS Feed