30 years ago, my wife and I purchased a townhouse as our first home together. The mortgage that we took out at the time was a 30-year adjustable, at about 9.5% (I can't recall the actual interest rate at the time - but that's pretty close).

While it was tempting over the years to refinance for a variety of reasons -- we didn't. The interest rate slowly declined until it actually hit a floor of 5.125% a few years ago when interest rates were in the low 3% range. But by that time the payments were mostly principal reduction, so refinancing didn't make much sense.

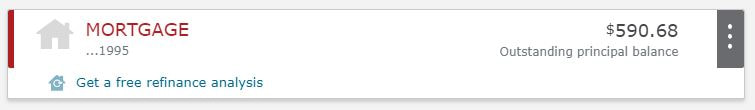

And now, here we are, 30 years later, with one payment left! Never thought I would see the day!

UPDATE - Just received a letter from Wells Fargo regarding my last payment. As a reward for making all of my payments on time for the past 30 years, I'm now required to send my last payment in via wire transfer or cashier's check (requiring an unnecessary trip to the bank). Thanks Wells Fargo -- for (making me) go the extra mile!

RSS Feed

RSS Feed